Emergency Budget: What to expect

The sums

At the heart of the fairness problem is value-added tax. Bookmaker William Hill has odds of 1/7 that it will be going up and just 4/1 that it will remain at its current 17.5%, reflecting the widespread expectation it could be increased to 20%. That would only make the average iPod £3 more expensive, but it could have a significant impact on the poorest paid. It’s an indirect tax which means it affects lower earners more. It’s also likely to affect retailers, who will be forced to pass most of the extra cost on to their customers by boosting prices.

The VAT hike can’t be taken by itself, however. Central to the coalition government’s taxation plans will be the inclusion of the increase in the income tax threshold, which will rise to £10,000. This measure, giving people more money in their pockets, could see them going out to the shops to spend it. It will help middle-income as well as lower-paid earners, undermining the coalition’s arguments elsewhere about cutting benefits and child tax credits for the better-off. It will certainly please the Liberal Democrats, who made the measure a key red line in their coalition negotiations with the Conservatives.

But, again, it can’t be taken by itself. Its impact will be significantly reduced by changes to national insurance rules.

The ‘jobs tax’ controversy which dominated the start of the general election campaign revolved around Labour’s plans to raise NI contributions for both employers and employees by 0.5% from 2011 onwards. Employers seem satisfied enough. The threshold increase is going ahead and, although this will not completely offset the raised contributions, it’s keeping the CBI happy.

But things are very different for employees. The Tories had planned to offset the contributions increase by raising NI thresholds, but these have now been scrapped because of the income tax allowance hike. The Treasury says employees earning less than £20,000 will, on balance, pay less overall.

Yet the triangle of VAT, income tax and national insurance means something is still missing. Overall, one thing is for certain: taxes are going up, by an expected £15 billion.

The income tax threshold increase must also be paid for by an increase in capital gains tax, which is likely to rise from its current 18% level to around 40%. Senior traditional Tories like David Davis and John Redwood have recoiled in horror at this proposal, mounting a concerted campaign to talk the chancellor out of the move. Redwood has called for a tapered CGT when it comes to non-business assets, penalising those who are selling on a property after only a few years. He also argues this is a tax where a higher rate does not necessarily equate to a higher revenue for the Treasury. Osborne has some tough choices to make as he considers whether to accept Redwood’s arguments.

The politics

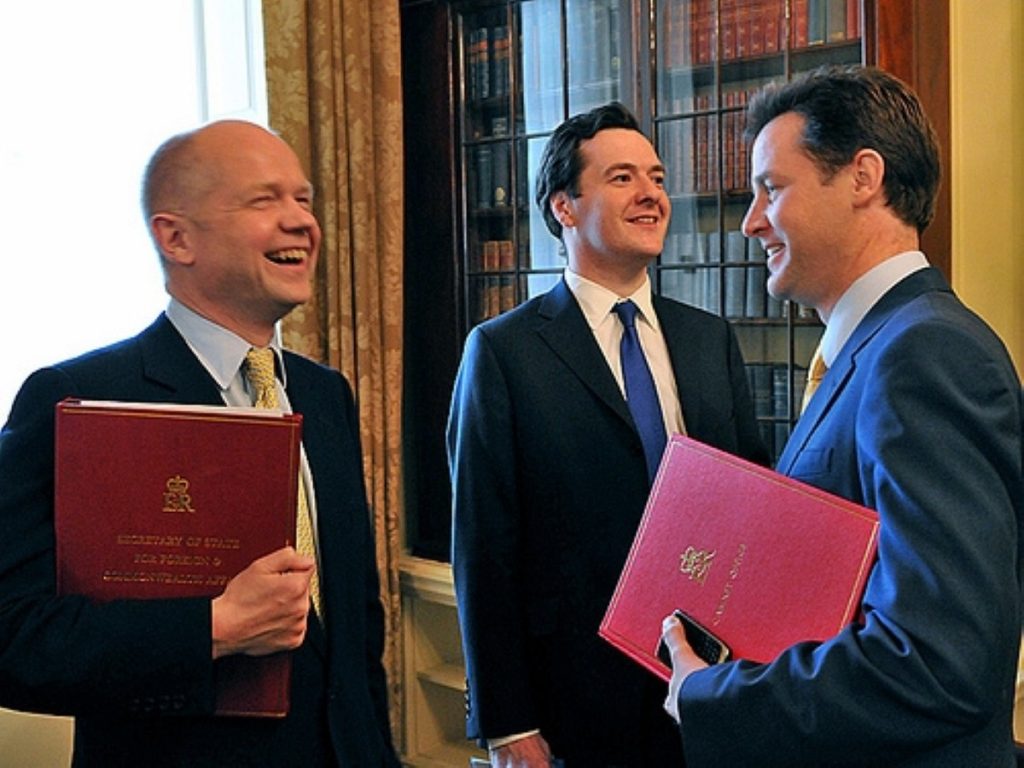

Coalition makes it easier. When the Tories were forced into negotiations with the Liberal Democrats, many senior Conservatives were said to be secretly pleased. They realised the political advantages of such an approach. Without the Lib Dems, the Tories were more open to the charge of being uncaring, old-school Conservatives, their stone hearts unmoved by the travails of the poor and needy. With Nick Clegg and co on board, they have a holistic government, with lefties and Tories alike arguing for the necessity of a deficit reduction plan.

A recent Clegg speech posited that the deficit reduction plan was in fact progressive, because it meant taxpayers’ money could eventually be spent on schools and hospitals rather than interest on debt. Expect that argument to play a major role in the next few weeks as the government tries to map out its arguments in the broadest political terms, alienating as few people as possible.

A similar attitude will be adopted towards MPs, with concerted efforts to keep right-wing Tories and left-wing Lib Dems happy. The Lib Dems will get their income tax policy and capital gains tax reform (although this is likely to be slightly watered down). The Tories will get national insurance and VAT, probably.

But compromises are always dangerous and problematic things. Sometimes they secure a middle ground, sometimes they end up pleasing no-one. Given the state of the challenge, and the apocalyptic warnings from the government ministers and some financial experts, MPs are likely to get in line, but not without some grumbling.

What’s particularly remarkable about the emergency Budget has been the sophisticated and careful PR surrounding it. Clegg and David Cameron both have PR backgrounds and it’s plain to see. Every day a minister stands up to tell everyone the problem is far worse than expected, as the public are consistently softened up for the bad news to come. Clegg then spouts progressive messages to keep the lefties on side, even if they remain uncomfortable with the general thrust of what is happening.

This entire process has been rigidly mapped out, not just economically and politically, but also in terms of public relations.

Today’s demand from the CBI for more anti-strike laws and the TUC’s harsh angry response show how quickly tribal responses to the plan will emerge, however. It’s harder to form a compromise or a PR slogan for such deep-seated animosities. Expect more of that to come.