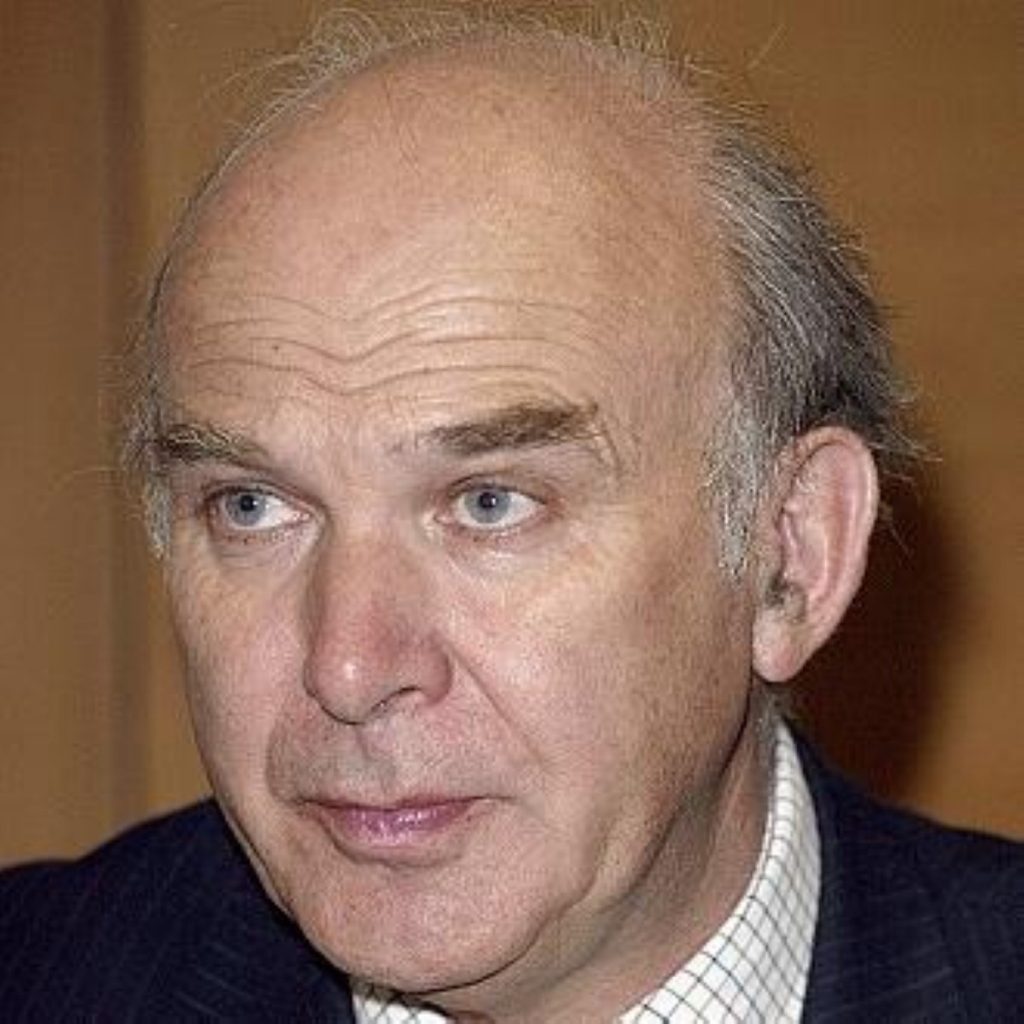

Vince Cable conference speech in full

Read Vince Cable's speech to the Liberal Democrat spring conference in full on politics.co.uk.

The question you should ask me and my colleagues in government: are we making a real difference? We need to show that the short term political cost of making unpopular decisions is outweighed by the longer term gain in credibility from helping to dig the country out of a massive economic hole.

For myself, in the last few weeks I have been able to deliver and announce some concrete results for the North East: evidence that beyond the cuts and the pain there is growth and jobs, and a rebirth of the region’s manufacturing traditions.

On Tuesday I was in Geneva launching the new Nissan Compact which is to be built in Sunderland, one of the world’s most productive car plants, creating 2000 new jobs, there and in the supply chain.

This project didn’t fall from the skies; it was the result of a committed workforce work and also support from the Regional Growth Fund. And when I went to see Nissan in Yokohama, the talk wasn’t just about new models but bringing the supply chain back to Britain. That is now happening.

Three weeks ago I launched a collaboration between Strathclyde University and the renewables testing centre, NAREC, in Blyth in Northumberland, and their commercial and university partners, to develop offshore renewable energy technology. That will provide the technological base for a big new industry beginning to take shape in the ports of the North East.

Then there is the imminent return of steel making to Teesside. I want to pay tribute to Ian Swales; what a fantastic campaigner he is as MP for Redcar.

A few miles down the road at Newton Aycliffe, Hitachi has announced it plans to build a state of the art manufacturing plant for a new generation of British trains, bringing 700 new jobs to the area. And just like Nissan in Sunderland, we are providing real financial support to make it happen.

Of course it isn’t all good news. Far too many people in the North East and throughout the country are out of work. There are painful factory closures – like the aluminium smelter in Northumberland, caused by excess capacity in the global economy. Government has an obligation to help the numbers who are losing their jobs.

What we must do is to intervene to support growth and new jobs. And as Liberal Democrats in government we must confront the old fashioned, backward-looking, negative thinking which says that all government needs to do to generate growth is to cut workers’ rights, slash taxes on the rich, and stroke ‘fat cats’ until they purr with pleasure.

I am sometimes told that I am single-handedly blocking the Government’s deregulation agenda. In fact my excellent team of Lib Dem and Conservative Ministers is doing more to stop or reverse unnecessary regulation than any previous government. If my critics really mean it, let us join in supporting business demands to hack away at the impenetrable red tape which makes our tax system such a nightmare for small businesses.

And let’s cut through the time wasting bureaucracy around foreigners working and studying here when they have every right to be in Britain. That’s what business means when it talks about ‘anti-business’ policies.

This is where the values of our party matter. As a Liberal party we believe in the importance of successful business, markets and genuine competition.

But as a Social Democratic party also we believe that government intervention can be a force for good, recognising that markets can and do fail. Our two traditions on the centre-left of British politics gave Britain its two great reforming governments last century in 1906 and 1945 and we must set the agenda for this century.

These days I am amused rather than offended when I come under attack from some Conservative backwoodsmen– one recently identified me as a member of the Socialist Workers Party: that, for advocating policies which would be considered mainstream in successful Scandinavian countries or Germany or France or even, in that socialist paradise, the United States.

The problem is that there are two crude stereotypes here: the British for free enterprise, the Continentals for state control.

But we, as Liberal Democrats, believe that active government can be a force for good, working with the grain of markets. That’s why I am developing an industrial strategy at the heart of the government’s commitment to grow our way out of Labour’s grim legacy of debt and broken banks.

I use the phrase ‘industrial strategy’ deliberately since we have an underlying problem of short term-ism: a ‘boom and bust’ mentality in financial markets, an obsession with short term results, which has been allowed to swamp strategic, long term thinking about how Britain will make its living.

This isn’t just my view. It is what the business community itself is telling me. They say that we in government need to get behind Britain’s successful sectors and firms. Many are foreign owned, but that doesn’t matter. Provided they invest good money in Britain operate responsible businesses and pay their taxes I don’t care what colour or creed their owners are. Britain’s leading manufacturer is Indian; our top car companies are German, Japanese, and American; our big new steel producer is Thai. New wind turbine manufactures are being developed along our coastline with investment by German, Danish and Spanish firms. All are employing British workers and supply chains. We shall succeed as a country by being open – to ideas, capital, technology, and of course, talented people.

Our party must have no truck with narrow nationalism and our government must make that clear to our allies in Europe

The success I want us to get behind is in the automotive sector, aerospace, chemicals, life sciences – not least in Newcastle – in creative industries – information technologies like internet shopping where the UK is a world leader; film; music; design; professional services, and universities – which happen to be among our biggest export industries.

Manufacturing is a large part of this. There has been a shameful neglect of manufacturing under successive governments. But it still responsible for over half of visible exports, much of the country’s R&D and two and a half million jobs.

Industrial Strategy involves active government, not sitting on the sidelines. We are identifying and supporting work on the technologies of the future: in advanced manufacturing; renewable energy; cell therapy; interconnected digital; intelligent transport; and next generation computing.

As you know, I have also prioritised apprenticeship training – we have had a 50% increase over the last year and we targeting apprenticeships in advanced skills and SMEs. And it is these – small and medium sized companies – which are the lifeblood of the economy and crucial for recovery.

We are also changing the short term, one-off approach towards major government procurement contracts so that, wherever possible, they take account of British supply chains.

We are directly supporting private investment with matching funding through the Regional Growth Fund – almost a half of its 170 plus projects so far are in the North East.

British business can’t succeed without access to capital. But three years on from the banking crash our recovery is still being throttled by lack of finance. Business must to be irrigated by bank capital but the irrigation channels are still silted up.

Banks have now become highly risk averse, and tougher regulation reinforces risk aversion. Yet banks regard most small and medium sized companies are inherently risky. Innovation is risky. Low carbon is risky. Exports to high growth emerging markets are risky. Who or what will plug the gap?

If Britain is to emerge from this dreadful crisis, business needs access to finance, just as plants need water – and the banks aren’t supplying it. We have several options, none of them easy or palatable.

We can sit around slowly waiting for banks to recover their nerve and sort out their balance sheets; but in the meantime good companies and jobs go down the pan.

The taxpayer can guarantee or subsidise lending on an even bigger scale but, that is nationalising risk and privatising profit.

We can get the partly state-owned banks to lend more: we have done a bit of that and must do more, but we are then up against EU competition rules.

We can also try to mobilise some new sources of funding – supplier finance from big companies; business angels and venture capital; pension funds and insurance companies all this has already been happening, but will move faster with Government support.

Financial markets have failed and we need thoughtful, intelligent government to take a lead. We have succeeded in getting the UK Green Investment Bank off the ground. My Department is already analysing the suggested first batch of Green Economy projects for investment; energy efficiency schemes, waste projects and renewables.

I want to acknowledge here the big contribution Chris Huhne has made to the green agenda and more than that, acting as a powerful voice for our party in government.

Apart from the Green Investment Bank, one of the contributions I am proudest of is a giant step to make the banks safe. George Osborne and I jointly set up the Vickers Commission and we have committed the government to make its proposals law before the next election.

Our changes will split up the big banks so that in future bankers cannot gamble and gorge themselves on fat bonuses on the back of a taxpayer guarantee. This morning’s news about the excess of bankers pay reminds us how urgent action is required. But when the reforms are in place we will be ahead of the rest of the Western world in bank reform. There is no way this would have happened without Lib Dem participation in government.

Responsible capitalism is the theme I have been seeking to develop since our party conference in Liverpool eighteen months ago. Most businesses are responsible, and want to be, but some of the more entrenched vested interests treat any reference to corporate abuses as ‘anti-business.’ And as Liberals we must always fight to promote competition and protect the consumer from the threat of monopoly power.

When I talk about responsible capitalism I am clear that there should be rewards for success, for entrepreneurs and for good management. But there is no justification for the massive escalation of top pay over the last decade, unrelated to the performance of companies let alone pay in general.

I have put forward proposals to exert greater shareholder control over their companies, including binding votes on pay. I want to see much more employee-engagement and more varied representative boards – including many more women.

But I don’t pretend for a moment that more shareholder power – desirable though that is – will do more than scratch the surface of the inequalities of income and wealth, and the justified sense of social injustice which has grown in the last few decades of boom and bust.

That is why we must insist on a radical plan for fair tax which we developed in opposition through the Tax Commission: lifting low earners out of tax; shifting the tax base from income to wealth, especially high priced property; and cracking down hard on the shocking tax dodging culture – personal and corporate – which disfigures our country.

I believe more than ever that we were right to choose the responsibilities of office, to work and been seen to work in the wider national interest. But we shall succeed politically only if we communicate that this is about more than balancing the books. We are fighting for jobs, for British industry, for banks which serve business and not the other way around. And above all we fight for fairness and strong public services to protect all our people. That’s why I am a Liberal Democrat.