Tories tackle Britain’s debt crisis

The Conservatives have launched an action plan for tackling spiralling consumer debt, saying businesses, government and individuals must take urgent action.

Among the party’s proposals are a call for a seven-day “cooling off period” for store cards, which would prevent someone using a new card for a week after getting it.

The Tories also want greater financial education in schools, saying every child between the ages of 11 and 18 should be taught how to deal with money.

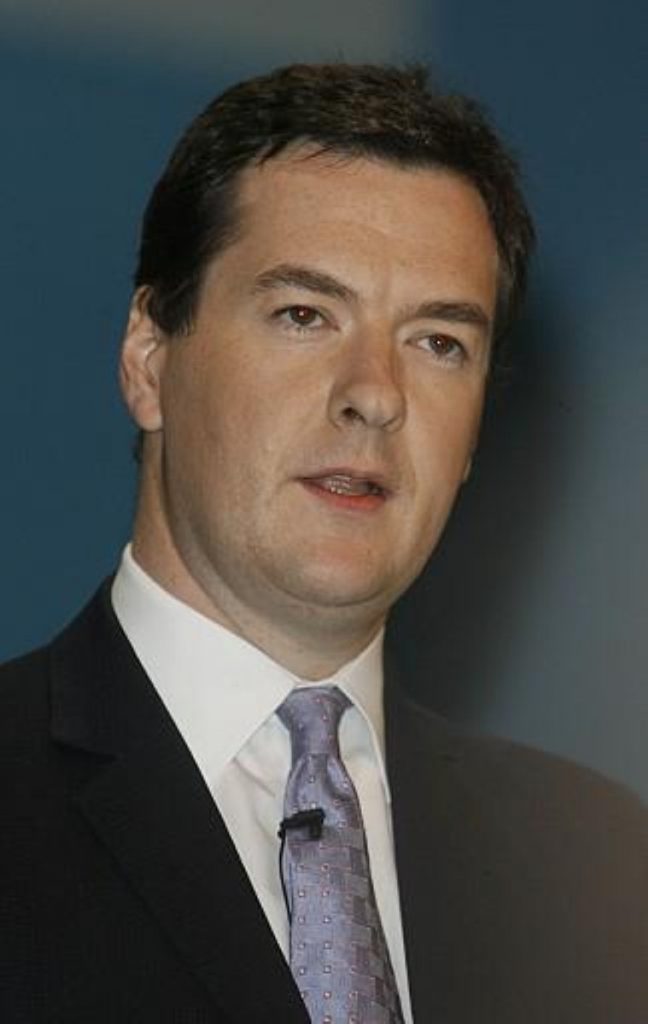

In a speech to a debt summit this morning, shadow chancellor George Osborne said the proposals would promote “personal, corporate and social responsibility”.

“We see tackling personal debt and financial exclusion as an issue of social responsibility. We’re all in this together,” he said.

However, Liberal Democrat Treasury spokesman Vince Cable accused him of being “utterly two-faced”, saying personal bankruptcies and home repossessions hit their highest levels under the Conservatives.

“For too long the Tories have been quiet on solutions to this major problem affecting households. It is simply not credible for them to pipe up now,” he said.

Mr Osborne warned that although many people found their debt was manageable, someone declared bankruptcy every seven minutes in the UK. The number of insolvencies in the first three months of this year was the same as in the whole of 1997.

Educating people was a first step to personal responsibility, he said, and organisations such as Citizens Advice Bureaux could help promote this alongside schools.

But Mr Osborne also argued businesses must also take responsibility for Britain’s debt problem, which saw an extra £1 million of personal debt accrued every four minutes.

Credit card providers must provide “much clearer” information to the public about how much borrowing costs, he said. This included making clear how much money consumers could save if they paid off more than the minimum every month.

The shadow chancellor also suggested greater data sharing between lenders, saying: “We should not allow people to take out that 10th credit card without the credit card company knowing about the other nine.”

He expressed concern about the widespread use of individual voluntary agreements – legal contracts between lenders and heavily indebted borrowers – and said people were often persuaded into committing to these deals where it was not necessary.

But Mr Cable warned: “This is nothing more than spin from a shadow chancellor who has no grasp of issues affecting British families. The Liberal Democrats have been warning about this issue for some time now, and for the Conservatives to jump on the bandwagon now is feeble.”