Massive rise in repossessions

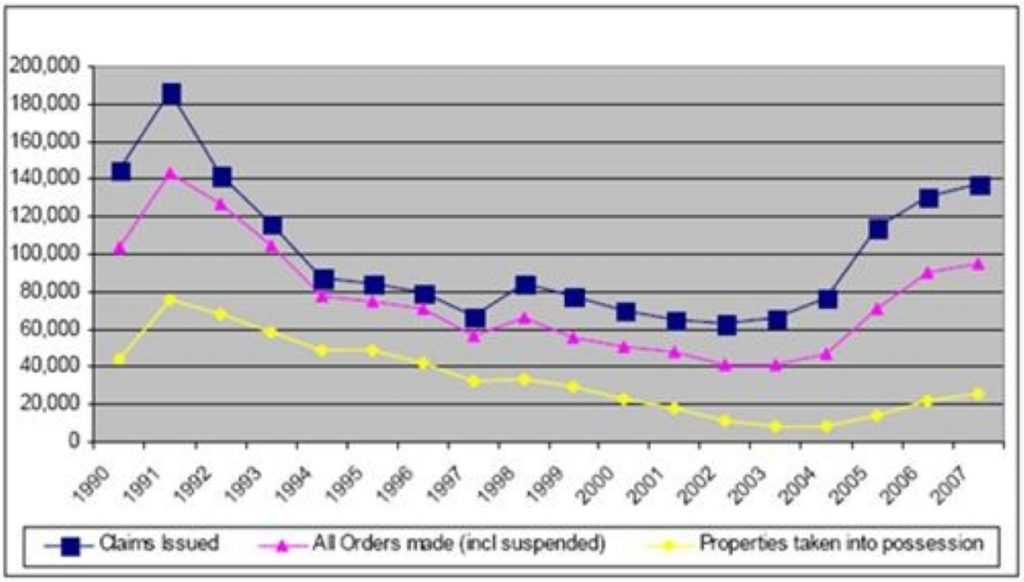

Repossessions have risen by 24 per cent in just one year, new Ministry of Justice (MoJ) figures have revealed.

Some 39,078 mortgage possession claims were issued on a seasonally adjusted basis.

However, possession orders do not inevitably lead to repossession occurring and can be abandoned at any time.

This said, there was also a sharp increase in the number of mortgage possession orders, the next stage in the repossessions process, being issued during the second quarter of the year.

“The level of growth of repossession orders suggests that we are on track for a repossession crisis very similar to the early 1990s,” said Liberal Democrat economics spokesman Vince Cable.

“It is absolutely vital that the government should intervene and require a proper code of conduct to be implemented by mortgage lenders.

“This should not just apply to the big banks but to the large number of secondary lenders who are using court action to pursue their debts in a very aggressive way,” he added.

The Conservatives said today’s figures highlighted Gordon Brown’s economic mismanagement.

“This is the human cost of Gordon Brown’s economic incompetence,” said shadow chief secretary to the Treasury Philip Hammond.

“He betrayed families by claiming he’d abolished boom and bust and encouraging a ‘spend now, pay later’ culture. Now times are getting tougher, thousands are losing their homes because they can no longer make ends meet.”

The MoJ reports 28,658 mortgage possession orders were made on a seasonally adjusted basis, 24 per cent higher than in the second quarter of 2007 and four per cent higher than in the first quarter of 2008.

In the whole of last year 26,200 properties were taken into possession.

Despite the increase, the Council of Mortgage Lenders (CML) has issued a note of caution.

While the MoJ figures report the number of cases that went to court and the number of court orders for possession granted, only the CML figures relate to actual possessions of properties by first charge lenders in the UK.

Last week the CML released data showing the number of properties taken into possession in the first six months of 2008 was 18,900. This represents 0.16 per cent of all loans in the UK mortgage market.

This compares with 13,400 in the second half of 2007, and 12,800 in the first half of 2007.

Furthermore, CML figures relate to the UK as a whole, while the MoJ considers just England and Wales.

In response to the increase, the CML is maintaining its forecast of 45,000 total possessions and 170,000 mortgages in arrears of more than three months by the end of the year.

These numbers remain extremely small when seen in the context of the 11.74 million mortgages in the UK, argues the mortgage industry trade body.