Parties at war over non-dom donors

The row over ‘non-dom’ donors escalated further in a day of bitter infighting across Westminster on Tuesday.

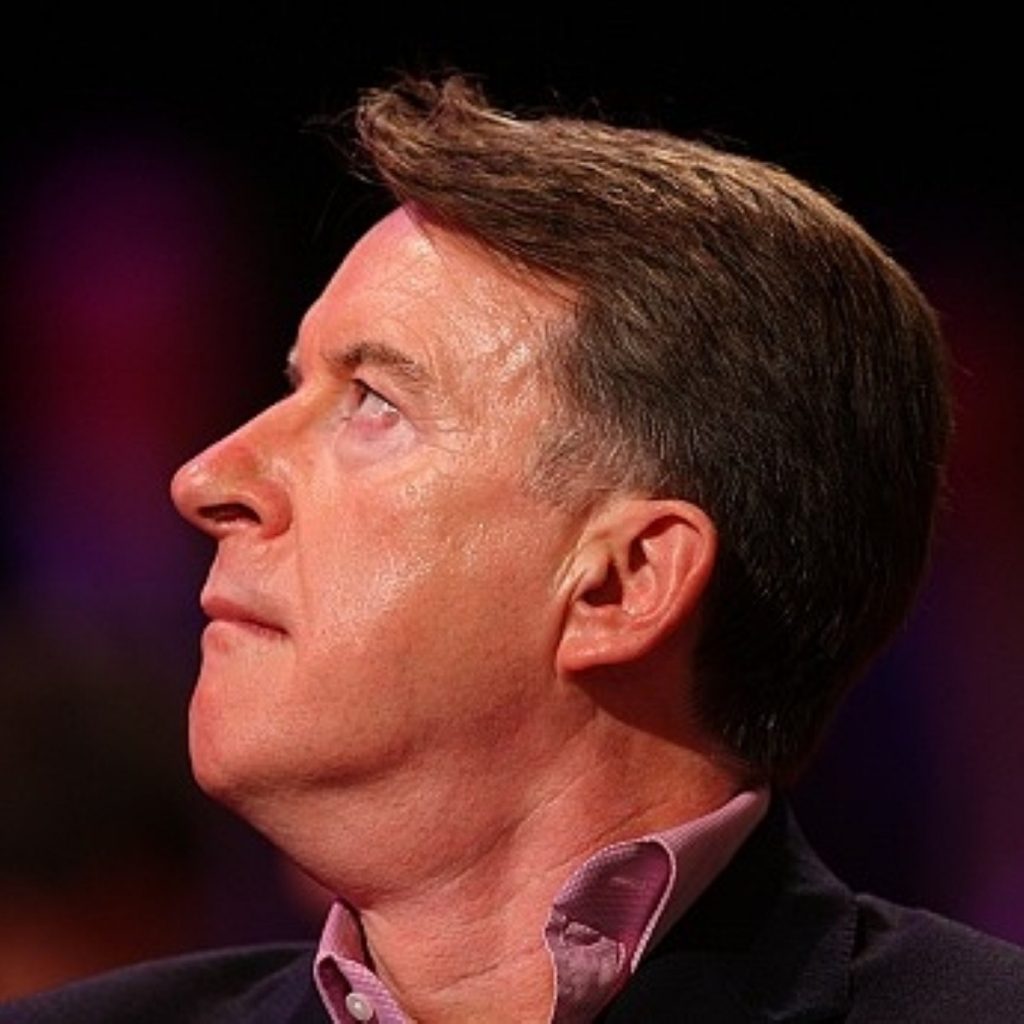

The Conservatives put in a freedom of information request against a Labour donor after Peter Mandelson’s attempts to shine further light on the tax status of Tory donor Michael Ashcroft were thwarted earlier.

The Liberal Democrats subsequently called on HM Revenue and Customs to assess Lord Ashcroft’s back tax payments in the light of revelations about his tax status.

Yesterday Lord Ashcroft ended years of unanswered questions about his tax status by confirming he is a non-domicile – meaning he does not pay income tax in Britain on his money earned through his overseas businesses.

The Tories’ move to seek further information about Lord Paul followed the intensification of Lord Mandelson’s attacks on Lord Ashcroft this morning, despite the Lords’ appointments commission refusing to mount a probe into the Tory donor’s peerage.

Lord Mandelson wanted the commission to check whether Lord Ashcroft’s non-dom status meant he had failed to meet all the requirements for being a peer.

The commission responded by explaining that as the case took place before its formation – Lord Ashcroft was ennobled in 2000 – it did not have authority to launch a probe.

“The vetting of Lord Ashcroft took place before the commission was established in 2000 and the commission has no documentation on this case and no retrospective powers to investigate,” it explained in a statement.

The first secretary of state responded by telling journalists in Downing Street that the relevant papers “exist somewhere” and that a freedom of information request should be used to put them before the public.

“What is unique about Lord Ashcroft is he is absolutely central to the whole Conservative electoral machine,” he said.

“He has a seat in Conservative party headquarters. He has what he regards as his own staff in marginal seats… money that he might have given in tax he has instead given to the Conservative party to help them buy these seats, to help them steal the election.”

Lord Mandelson added: “That is why people are entitled to know the truth about him. That truth has still not fully come out.”

Tory leader David Cameron pointed out that several Labour donors, including Lord Paul, were non-doms.

“I’m pleased we have resolved this issue so we can now get on with the election,” he said to an audience in Canary Wharf.

“I admire people who want to try and flog this dead horse but the horse is dead and should no longer be flogged.”

But the Lib Dems called for an HMRC investigation into the Tory peer, with their home affairs spokesman Chris Huhne estimating Lord Ashcroft’s tax savings from his non-dom status stood at around £127 million.

“Having declared his permanent residence as a solemn and binding undertaking… could you confirm that any permanent resident should pay full UK tax on worldwide income?” Mr Huhne asked HMRC’s chief executive Lesley Strathie.

“Since Lord Ashcroft’s worldwide income on an estimated fortune of £1.1 billion is likely to be at least £55 million a year, and the tax savings from non-dom status was likely over ten years to exceed £127 million, this is an important and urgent policy matter.”

A memorandum published yesterday, sent to then-Conservative leader William Hague in March 2000, stated that Lord Ashcroft understood he only needed to be resident in Britain for tax purposes to qualify for the peerage.

A parliamentary committee had rejected his application for ennoblement in 1999, on the grounds that he spent much of his time – and did most of his business – overseas, mainly in the Central American state of Belize.

In a statement yesterday Lord Ashcroft said the “interpretation” of his requirements had changed after he was ennobled, meaning he only needed to be a “long-term resident” of Britain.